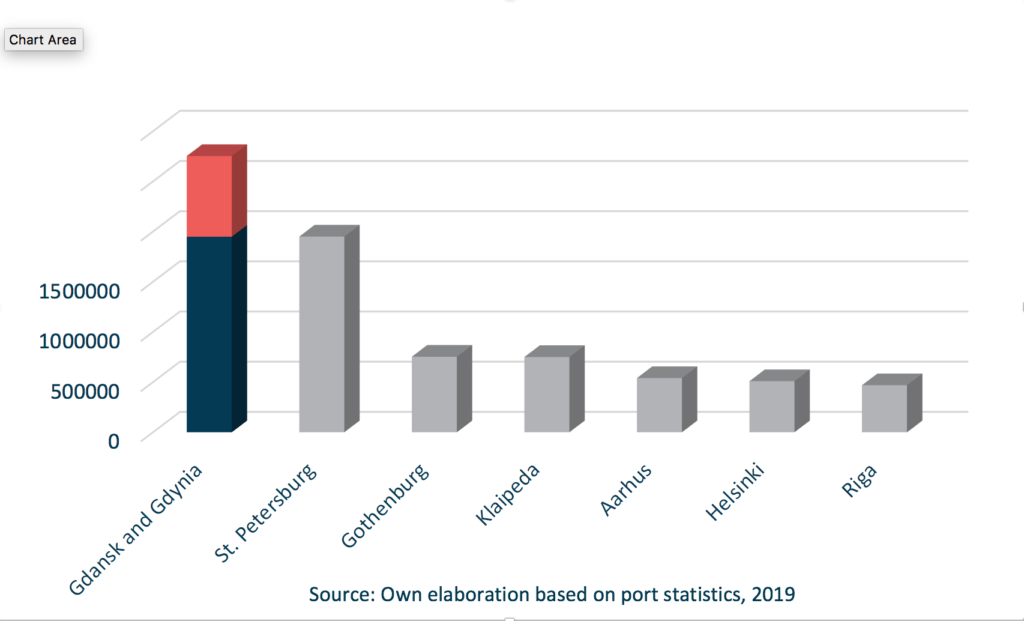

Pomerania stands out from all the other regions in Poland due to it’s coastal location and presence of deep-water ports. The two Pomeranian ports (Port of Gdansk and Port od Gdynia) can handle all kinds of cargo and unlike Russian Baltic ports remain tideand ice-free all year round. In 2019 high transshipments both port kept their record for the fourth year in a row. Total volume od the cargo transshipped stood at 76 million tonnes. Container handling is undoubtedly the key driver of the growth. The main contributor to this result was DCT Gdansk (Deepwater Container Terminal).

With direct calls from Asia, the terminal has become a port hub for the CEE region inhabited by nearly 100 million citizens. Growing global trade, progressive process of containerization and expected economic growth in CEE (the faster growing region on Europe) will definitly enhance the container business in the next decade.

Find out more about the maritime sector.

Warehousing market

Tricity warehousing stock has been constantly growing since 2006. Due to an impressive market growth from approx. 80,000 sq m (Q1 2008) to over 670,300 sq m (2019) recorded over the last decade, Tricity became the largest logistics hub in Northern Poland. Most of the logistics parks are located along Expressways, A1 Motorway and in the vicinity of the seaports.

Warehousing market growth was fueled mainly by two factors – the development of the two Pomeranian ports (Port of Gdansk and Port of Gdynia) as well as the development of the network of expressways and motorways in Poland. The real game changer, how – ever, was introduction of direct calls with Asia and thus growing volume container handling. Unlike office market, foreign developers dominated the market. The biggest players including Panattoni, Prologis, GLP, Segro and Poland-based 7R are active around Tricity. Recently, a new trend within the warehouse market has been noted. There is a growing number of smaller logistics parks offering smaller modules which is in line with the ‘last-mile’ logistics model. Projects of these type are usually located within the cities or their direct vicinity. Such solutions enable optimizing transportation costs and shortening delivery time to final customers lo – cated in expanding cities such as Warsaw, Tricity, Poznan, Wroclaw and Cracow.

In 2019 gross demand on the warehousing space market in Tricity was a record-breaking 176,100 sq m., with net take-up reaching nearly 155,300 sq m. Vacancy rate at 4.6% (increase by two percentages point YOY) remains below the country average which is estimated at around 6,7%.

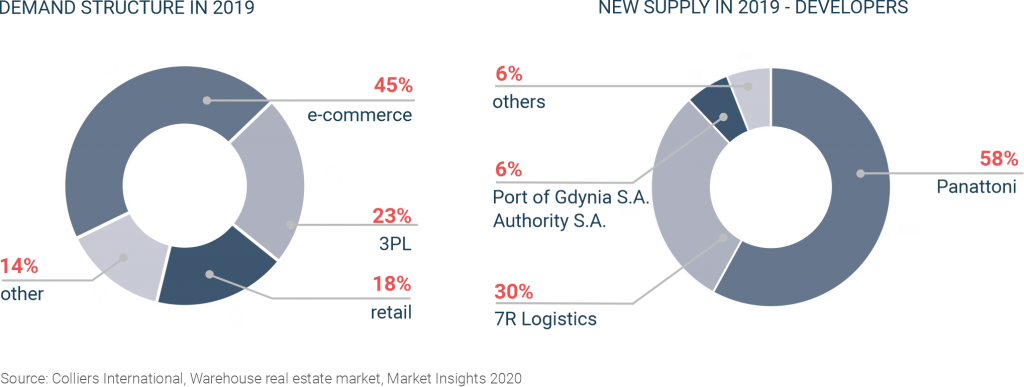

E-commerce and 3PL (Third Party Logistics) have topped the leasing activity over the past twelve months. Sectors were responsible for 45% and 23% of all space take-up ine the region.Nearly 18% of warehouse space was leased by retail sector. Demand for the logistics space is set to double over the next decade.

Tricity warehousing market in 2019 was dominated by new deals, which accounted for more than half of all contracts concluded (57%). BTS (Build-to-suit) had a 37% share in all transactions, whilst expansion and renegotiations accounted for only 5% and 1% respectively. 39 lease contracts have been signed.

Effective rents were in the range of EUR 2.3-2.9 sq m/month. The level of rent rates may change again – the continuing upward trend in the cost of building materials and labor costs plays a significant role in this case.

Strong demand for the werehouse space reflect macroeconomic data. For the last years the Pomeranian economy has been growing at a fast pace reaching 7% in 2018. What’s worth noticing, the economic meltdown coused by covid-19 hasn’t stopped the hot werehouse market as e-commerce boosted demand.

Logistics facilities

Pomorskie also offers a well-developed and constantly expanded logistics base. The Pomeranian Logistics Center (PCL) is located on an area of 110 hectares in the vicinity of DCT Gdańsk, which – thanks to its location at the container terminal – fully implements the Port Centric Logistics concept. On the other hand, in the area of the Port of Gdynia, there is a Logistics Center adapted to the needs of logistics operators, shipping companies, companies dealing with storage services and other logistics service providers.

The road and rail infrastructure is also intensively expanding, including along the axis of the Baltic-Adriatic transport corridor, through which there are import and export cargo flows in Poland’s relations with other countries of the north and south of Europe.